Part A and B

Original Medicare, composed of Parts A and B, serves as the cornerstone of healthcare coverage for seniors. It offers comprehensive benefits and enjoys wide acceptance nationwide. This essential coverage encompasses various medical services such as hospital stays, physician consultations, preventive care, and necessary medical supplies.

Seniors have the flexibility to visit any healthcare provider who accepts Medicare, empowering them to select their preferred doctors and specialists. Moreover, Original Medicare lays a sturdy groundwork that can be enhanced with supplementary coverage options tailored to meet individual healthcare requirements.

What Does Part A Cover?

Medicare Part A provides coverage for hospital expenses.

- It includes hospice care as well as other services provided by healthcare facilities, such as skilled nursing facility care and inpatient hospital stays.

What Does Part A Cost?

Medicare Part A is often affordable for most people, and for some, it may not require a monthly premium. To be eligible for premium-free Part A, you need to have paid Medicare taxes for at least ten years. If you haven’t paid Medicare taxes for that long, the monthly premium for 2023 can be either $278 or $506.

What Does Part B Cover?

The Medicare medical insurance component is known as Part B.

- Medicare Part B covers a range of healthcare services, including doctor visits, ambulance services, durable medical equipment, mental health services, preventive services, and medically necessary treatments.

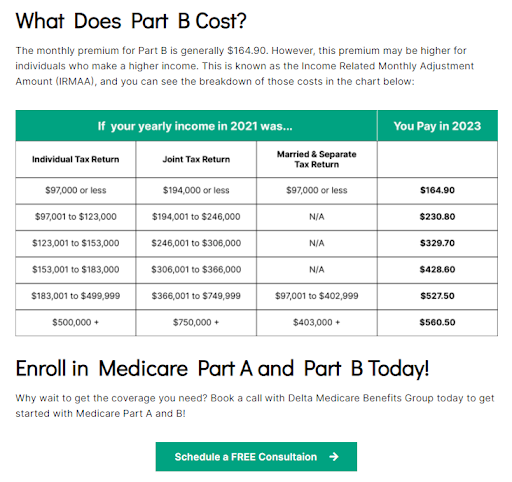

What Does Part B Cost?

The standard monthly premium for Part B is $164.90. However, individuals with higher incomes may have to pay a higher premium known as the Income Related Monthly Adjustment Amount (IRMAA). You can find the breakdown of these costs in the chart below:

Enroll in Medicare Part A and Part B Today!

Why put off getting the necessary coverage? To begin with Medicare Parts A and B, schedule a conversation with Insurance Corner Medicare Group right away!

Koran Smith

Owner & Licensed Agent

- (864)-396-2681

- koran@myinsurancecorner.com

- Message Us

By clicking “Next”, you agree to our Terms of Service and Privacy Policy. You also elect to receive updates, newsletters, and offers from Delta Medicare Benefits Group.